Upwards Insurance Group

Upwards: Toward a higher or better condition or level.

The technical definition is a great reflection of our mission and what we are aiming to bring to our clients when it comes to their insurance coverages and what they pay for insurance. At Upwards Insurance Group, LLC, we strive to empower individuals and businesses to ascend to a higher level of confidence and security through informed insurance choices. We are committed to delivering personalized service, tailored solutions, and unwavering support, leading our clients towards a better condition of well-being.

At Upwards Insurance Group, LLC, we approach insurance as more than just a financial transaction; it's a pathway to security, peace of mind, and financial elevation. We've developed a range of innovative insurance offerings that cater to the diverse needs of our clients, setting us apart as an independent broker in the insurance industry.

As an independent insurance broker, Upwards Insurance Group is uniquely positioned to offer a wide range of insurance products from multiple carriers. This flexibility allows us to provide clients with tailored solutions, differentiating us from larger, one-size-fits-all insurance providers.

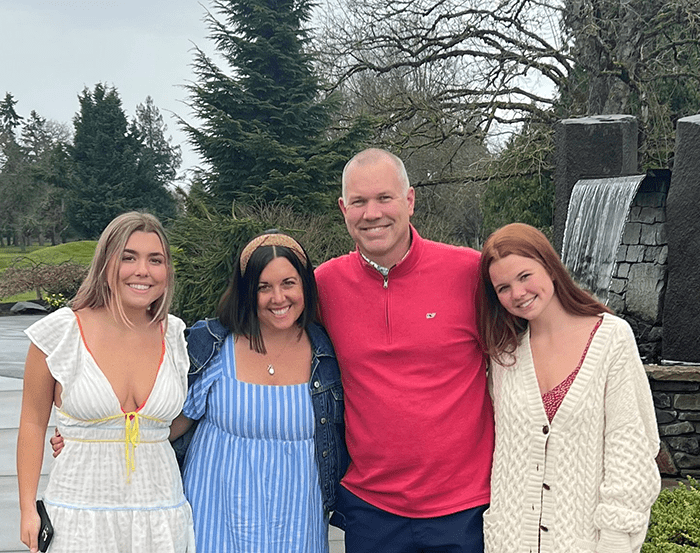

Ty Lockard

Upwards Insurance Group, LLC was founded by Ty Lockard in January of 2023 just prior to the acquisition of its first independent agency, Creswell Insurance. Insurance is not a new venture for Ty, he has over 20 years of experience, as an agency owner, as well as a carrier sales rep for top-level insurance companies. Ty is married and a family man with 2 beautiful daughters; Elle, who is attending the University of Oregon and Maggie, a junior at Lake Oswego High School. Ty loves to golf when time permits and enjoys traveling, boating, and cheering on his Oregon Ducks and LA Chargers, GO DUCKS & BOLT UP!

Scott Reese, ARM

After 26 years in the insurance business, Scott collaborates with others to change the way people think, feel and experience Risk Measurement, Risk Mitigation and Risk Transfer withing the Insurance transaction. In addition to serving as a client adviser to several regional and national businesses, Scott designs and implements association group insurance programs including risk management programs for clients, alternative market (captive) arrangements, education training and quality management initiatives. By utilizing his expertise in healthcare, real estate, construction and other areas, Scott helps clients manage and finance their commercial and human capital risks.